31/2 LIBRARY ROAD, BHADRESWAR, HOOGHLY - 712124

Whatsapp Me

Whatsapp Me

Investment Specialist, Retirement Specialist, AMFI Certified Mutual Fund Distributor, Member BSE, Certified Insurance advisor, Ex Financial Consultant @HDFC Life, Ex- Air Warrior from Indian Air Force of 20 years of service in Admin branch. Graduated from SMU and IGNOU. Having many recognitions from financial institution.

Why Choosing Us!

We are in financial guidance business which helps addressing people’s financial planning needs, larger wealth management concerns and details of managing their portfolio by defining their goals, asset allocation, assessment of risk profile and identifying investment horizon.

Atanu Sur, is committed to assisting you in achieving your unique financial goals, while freeing your time, and your life, of the day-to-day worries of managing money and making sure that your money works for you as hard as you work for it.

Dedicated mobile application, 24X7 services, no limit in geography!

Single registration lifetime hassle free transaction with BSE.

We follow Phygital process. more authentic and secure!

Experience swift success with our fast execution. From idea to action, our efficient processes ensure rapid results, putting your goals on the fast track to achievement with world's fastest exchange BSE a speed with 6 nanoseconds.

Read MoreEnsure peace of mind with our robust financial security measures. Your data is protected through cutting-edge technologies, offering a secure foundation for your financial endeavors.

Read MoreEmpower your journey with our unwavering guidance and support. We stand by you, providing expert assistance and personalized solutions for your success.

Read MoreOur Services

Prioritize your well-being with our tailored health insurance coverage. We are dedicated to providing financial protection and support, ensuring peace of mind for you and your loved ones in every step of your health journey.

Read More

Life insurance is a crucial financial tool providing a safety net for loved ones in case of death. It ensures financial security, settles debts, aids in estate planning, and may offer tax advantages. Types include Term, Whole, and Universal Life Insurance, each catering to different needs. Consulting with a financial advisor is key to choosing the right plan for your family's future security.

Read More

Mutual funds offer a diversified investment approach, pooling money from multiple investors to invest in a variety of assets. They provide a convenient way for individuals to access professional fund management and diversify their portfolios. With options like equity, bond, and balanced funds, investors can tailor their investments to match financial goals. Consulting with a financial advisor is recommended to select the most suitable mutual fund strategy based on individual risk tolerance and investment objectives.

Read More

Personal loans serve as versatile financial tools, providing individuals with a lump sum amount for various needs, from debt consolidation to unexpected expenses. These loans offer fixed interest rates and flexible repayment terms, making them accessible for diverse financial situations. Borrowers can use personal loans to cover medical bills, home improvements, or other immediate financial needs. Before opting for a personal loan, it's essential to assess your financial capability and consider the terms, interest rates, and repayment plans offered by lenders.

Read More

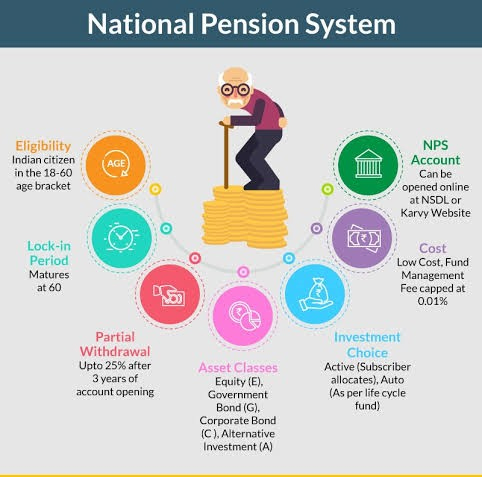

Investing in NPS offers significant advantages for retirement planning in India:

Tax Benefits: Enjoy tax deductions up to ₹2 lakh per annum.

Flexibility: Choose from various investment options and fund managers.

Long-Term Wealth Creation: Designed for disciplined savings and retirement planning.

Low Cost: Offers cost-effective fund management charges.

Read MoreGet In Touch