31/2 LIBRARY ROAD, BHADRESWAR, HOOGHLY - 712124

Whatsapp Me

Whatsapp Me

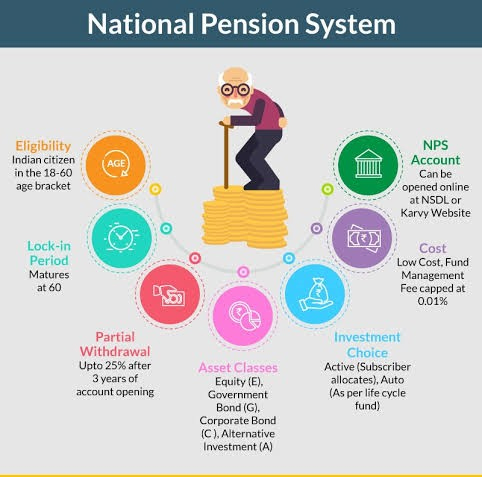

4. Low Cost: NPS has one of the lowest fund management charges among pension schemes in India, ensuring that a higher portion of your investment works towards generating returns.

5. Safe and Regulated: NPS is regulated by the Pension Fund Regulatory and Development Authority (PFRDA), ensuring transparency, safety, and credibility of the system.

6. Annuity Options: At the age of 60, when you exit from NPS, you can use a part of the corpus to purchase an annuity, providing a regular income stream post-retirement.

7. Portability: NPS is portable across jobs and locations, allowing you to continue your investments even if you switch jobs or move cities.

Investing in NPS can be a prudent choice for building a secure financial future. It combines tax efficiency, flexibility, and long-term growth potential, making it a valuable addition to your investment portfolio. Start early to harness the power of compounding and secure a comfortable retirement!